darwin-b2b.ru

Prices

Car Insurance For Poor Credit

On average, drivers with poor credit pay percent more for full coverage car insurance than those with excellent credit. California, Hawaii, Massachusetts. Car insurance costs more for drivers who have bad credit. Those who don't have the best credit history may want to check out Progressive, which has an average. Some insurers provide auto insurance with no credit check, which might seem appealing if you have a poor credit history. Insurance companies that do not use credit scores to determine premiums are less common in the market. · However, there are insurers and specific. credit score impacts your car insurance rates; Auto insurance rates for bad credit by state poor credit, as well as the cheapest companies for bad credit auto. MoneyGeek's analysis found that GEICO offers the least expensive low-income car insurance in New Jersey. The state's Special Automobile Insurance Policy. MoneyGeek evaluated the best and cheapest car insurance options for drivers with bad credit. Learn how drivers with poor credit can get the best deals. Add multiple cars to your policy: Adding multiple cars to your insurance policy can often lead to lower rates through multi-vehicle discounts. · Bundling auto. Based on Insurify's analysis of recent rate data, the cheapest auto insurance companies for drivers with bad credit scores are COUNTRY Financial, NJM, and Auto-. On average, drivers with poor credit pay percent more for full coverage car insurance than those with excellent credit. California, Hawaii, Massachusetts. Car insurance costs more for drivers who have bad credit. Those who don't have the best credit history may want to check out Progressive, which has an average. Some insurers provide auto insurance with no credit check, which might seem appealing if you have a poor credit history. Insurance companies that do not use credit scores to determine premiums are less common in the market. · However, there are insurers and specific. credit score impacts your car insurance rates; Auto insurance rates for bad credit by state poor credit, as well as the cheapest companies for bad credit auto. MoneyGeek's analysis found that GEICO offers the least expensive low-income car insurance in New Jersey. The state's Special Automobile Insurance Policy. MoneyGeek evaluated the best and cheapest car insurance options for drivers with bad credit. Learn how drivers with poor credit can get the best deals. Add multiple cars to your policy: Adding multiple cars to your insurance policy can often lead to lower rates through multi-vehicle discounts. · Bundling auto. Based on Insurify's analysis of recent rate data, the cheapest auto insurance companies for drivers with bad credit scores are COUNTRY Financial, NJM, and Auto-.

It's difficult to find affordable auto insurance because most insurance companies see those with poor credit as a higher risk, since they may be more likely to. Shopping around for coverage, working on your credit score and bundling your insurance policies could help bring down the premium, or the price you pay for. To determine this, insurers draw correlations by looking at your credit history, in particular your record of debt repayment. If you have a poor credit history. The best and cheapest car insurance for a bad driver will be a full-coverage policy from an insurer with a national presence and discounts. In most states you can't be denied insurance solely for credit, though many companies will use credit as a component of eligibility (ex: someone. How bad credit drivers can save money on auto insurance. While premiums are higher for people with poor credit, that doesn't mean there aren't ways to save. Compare cheap car insurance quotes from over UK providers, including Admiral. Looking to insure a car for less? Compare quotes from over car insurance. Drivers with bad credit may pay more for car insurance. But Insurify can help you find the cheapest rates. According to the III, if you have a better credit-based insurance score, an excellent driving history, and zero claims on your record, you'll typically qualify. If you wish to pay monthly then that is a different matter altogether. Insurers want to be fairly sure that you can afford the repayments and will make then as. Because auto insurance scores are largely based on your credit history, cleaning up your credit report and boosting your credit score can help you secure a. Poor Credit. For Minimum Coverage. For High Coverage. Cheapest Car Insurance Company in Every State. How to Get the Cheapest Car Insurance Quotes. Discounts. Even if you have bad credit or a bad driving record, you can still find car insurance. Discounts can include a Safe Driver discount, Good Student discount. Car insurance companies use different factors to estimate the risk of potential customers. When you buy your policy, your auto insurance company uses soft. automobile and homeowners insurance and how much to charge. "Credit scoring One could have a good credit score for lending, but a poor insurance score. Find cheap car insurance rates for drivers with bad credit. Insurance Navy offers affordable car insurance for bad credit drivers. Get affordable rates and. A: If you have bad credit, you can talk to your insurance agent or company to ensure you maximize the discounts on your auto policy. You can elect to pay your. In this comprehensive guide, we will explore the factors that affect car insurance premiums for drivers with poor credit. Studies show that using this score helps us better predict insurance losses. In fact, 92% of all insurers now consider credit when calculating auto insurance. Looking for car insurance, but got bad credit? Credit problems in the past should not prevent you from being offered car insurance, and should not affect the.

Pull Cash Out Of House

HELOC vs Cash-Out Refinance ; Disbursement, Access money on an as-needed basis (up to the credit limit) via credit or debit cards, electronic transfer, or checks. A home equity loan allows homeowners to borrow money using the equity of their homes as collateral. Also known as a second mortgage, it must be paid monthly. A cash-out refinance allows you to replace your current mortgage and access a lump sum of cash at the same time. The new mortgage will cover your home. Any home loan that has the funds released to you directly is considered cash out by the banks. You can cash out your equity in a home by refinancing your. Retired homeowners who have paid off their mortgage can sell their home and cash out the equity by downsizing. Further, homeowners 62 and older have the option. Learn about cash-out refinance mortgages and find out if accessing your home equity is right for you. Check mortgage refinancing rates at Wells Fargo. A cash out refinance option offers two big benefits. It allows you to turn your home's equity into cash plus lock in a lower interest rate on your mortgage. In other words, you can borrow up to 80% of your appraised home value. The more equity you have to begin with, the more cash you'll be able to take out. Some. But when you don't have an existing mortgage, a cash-out refinance is just a new first mortgage that lets you borrow a lot of money against your home. Can I get. HELOC vs Cash-Out Refinance ; Disbursement, Access money on an as-needed basis (up to the credit limit) via credit or debit cards, electronic transfer, or checks. A home equity loan allows homeowners to borrow money using the equity of their homes as collateral. Also known as a second mortgage, it must be paid monthly. A cash-out refinance allows you to replace your current mortgage and access a lump sum of cash at the same time. The new mortgage will cover your home. Any home loan that has the funds released to you directly is considered cash out by the banks. You can cash out your equity in a home by refinancing your. Retired homeowners who have paid off their mortgage can sell their home and cash out the equity by downsizing. Further, homeowners 62 and older have the option. Learn about cash-out refinance mortgages and find out if accessing your home equity is right for you. Check mortgage refinancing rates at Wells Fargo. A cash out refinance option offers two big benefits. It allows you to turn your home's equity into cash plus lock in a lower interest rate on your mortgage. In other words, you can borrow up to 80% of your appraised home value. The more equity you have to begin with, the more cash you'll be able to take out. Some. But when you don't have an existing mortgage, a cash-out refinance is just a new first mortgage that lets you borrow a lot of money against your home. Can I get.

How would one theoretically pull money out of their home? · If you get a HELOC, you're paying the bank interest to borrow against the money in. Yes. Many homeowners use cash-out refinances to get the funds they need for a down payment on a new property or buy a new home in cash if they have enough. A cash-out refinance is when a homeowner refinances their mortgage to a new mortgage (typically at a lower interest), and in the process, borrows more money. The transaction must be used to pay off existing mortgage loans by obtaining a new first mortgage secured by the same property, or be a new mortgage on a. You'll get your funds the fastest when using a home equity line of credit (HELOC), but a home equity loan typically won't take much longer. A cash-out refinance. Cash-out refinancing is appealing because not only do you get a sizeable piece of spending money to use for any number of projects or purchases, but if the. As you withdraw money from your HELOC, you'll receive monthly bills with minimum payments that include principal and interest. Payments may change based on your. Some lenders may allow you to take out all of your home equity depending on your credit score, for example, but others may not. With cash-out refinancing, you'. You could take out a home equity loan or line of credit, or you could refinance your mortgage and take out some extra money. However, be aware. Learn about cash-out refinance mortgages and find out if accessing your home equity is right for you. Check mortgage refinancing rates at Wells Fargo. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. To pull equity out of your home you'd need to do a second mortgage or take out a home equity line of credit, where the bank uses your house as. With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if. Popular reasons to refinance with cash out include: paying off credit cards, debt consolidation, home improvement, and money for personal expenses. As a direct. However, you can tap into your home equity without having to move. A cash-out refinance replaces your old mortgage with a new, larger loan. You pocket the. With a cash-out refinance, you pay off your current mortgage and create a new one, allowing you to keep part of your home's equity as cash to pay for the things. You take out a new loan for your current property value, pay off the existing loan balance, and keep the difference in cash. The cash is yours to do with as you. If you own a home appraised at a high value (and you have a small mortgage), you may be able to get more money. But you will increase your debt and possibly use. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow Take advantage of the information we have gathered. Popular reasons to refinance with cash out include: paying off credit cards, debt consolidation, home improvement, and money for personal expenses. As a direct.

What Does Bullish Vs Bearish Mean

Simply put, "bullish" means an investor believes a stock or the overall market will go higher. Conversely, "bearish" is the term used for. What is a bearish market? The definition of a bear market is one that has fallen in value by more than 20% for over a two-month period, during a period of. A bullish investor believes stock prices will rise, so they want to buy to benefit from the price increase. Bearish investors believe prices will drop, so they. What it means to be bullish. When someone is bullish, it means they are expecting prices to rise over a certain period of time. The term applies to broad market. Bearish is used to describe periods of economic recession. Bullish is used in the opposite instance, to describe a period of economic expansion. What does being bullish mean? If you have either a long- or short-term positive sentiment toward an individual stock, a stock index or the overall market, you'. Bullish and bearish are terms that describe the market conditions, trends, and strategies, based on the expectations and sentiments of the investors. A bull. A bearish market is identified by falling prices with a pessimistic outlook. The gloomy market perspective means that the prices are assumed to keep falling in. Being bearish is the opposite of being bullish, which means that you think the market is heading upwards. IG's trading apps · Spread betting vs. CFDs · Short. Simply put, "bullish" means an investor believes a stock or the overall market will go higher. Conversely, "bearish" is the term used for. What is a bearish market? The definition of a bear market is one that has fallen in value by more than 20% for over a two-month period, during a period of. A bullish investor believes stock prices will rise, so they want to buy to benefit from the price increase. Bearish investors believe prices will drop, so they. What it means to be bullish. When someone is bullish, it means they are expecting prices to rise over a certain period of time. The term applies to broad market. Bearish is used to describe periods of economic recession. Bullish is used in the opposite instance, to describe a period of economic expansion. What does being bullish mean? If you have either a long- or short-term positive sentiment toward an individual stock, a stock index or the overall market, you'. Bullish and bearish are terms that describe the market conditions, trends, and strategies, based on the expectations and sentiments of the investors. A bull. A bearish market is identified by falling prices with a pessimistic outlook. The gloomy market perspective means that the prices are assumed to keep falling in. Being bearish is the opposite of being bullish, which means that you think the market is heading upwards. IG's trading apps · Spread betting vs. CFDs · Short.

What separates bearish markets from bullish ones is the confidence of a price remaining high and rising, or remaining low and dropping. More to the point, the. Bullish definition · When someone is bullish, he/she is optimistic about the economy and in the financial markets. · Typically, such a person would expect the. When the market is bullish, that means the price is moving high, and when it's bearish, that means the price is moving low. The world of trading has had two words that have echoed throughout. The bull and bear markets are two words that you may have heard but what do they mean? A bull market shows increases in market sentiment, higher trading volume, and higher returns for investors. Conversely, a bear market shows signs of the. The stock market under bullish conditions is consistently gaining value, even with some brief market corrections. The stock market under bearish conditions is. A bear market exists in an economy that is receding, where most stocks are declining in value. Although some investors can be “bearish,” the majority of. What does bullish mean? Bullish refers to an investor that is confident a particular asset or the whole financial market, such as the cryptocurrency market. A bearish market is identified by falling prices with a pessimistic outlook. The gloomy market perspective means that the prices are assumed to keep falling in. Bullish vs bearish: what are the differences? · Bullish: A bullish outlook is optimistic and anticipates rising asset prices or a favorable market trend. What Do Bullish and Bearish Mean? The terms bullish and bearish define whether traders think that prices of an asset will rise or fall in the future. They are. Bullish vs bearish: what are the differences? · Bullish: A bullish market is characterized by rising asset prices, optimism, and a positive economic outlook. What Does Bullish Mean? The term “bullish” is used to describe positive market sentiment. Bullish investors are optimistic about the future of the market and. What does bullish vs bearish mean? Bulls believe that the price of a stock is going up. Bears believe it's going down. What is a bull market? A bull market, meanwhile, marks a period of rising market index values. Bull markets lack the same concrete definition of bears: You. What is a bull market? A bull market, meanwhile, marks a period of rising market index values. Bull markets lack the same concrete definition of bears: You. When talking about markets, be it stocks or crypto, the terms “bullish” and “bearish” are indispensable in a conversation. But what exactly do these two. What is a bearish market? The definition of a bear market is one that has fallen in value by more than 20% for over a two-month period, during a period of. Definition. A bullish market, often simply referred to as a “bull market,” is characterized by optimism, rising asset prices, and a generally positive.

How You Can Get Rich

Becoming wealthy starts by earning good money. You can do this in many ways: going to school, getting higher education and joining a high-paying profession;. How to Get Rich is an entertaining and informative tale about what it takes to amass a lot of money. Felix Dennis, an eccentric legend in the magazine. How to change your mind to become compatible with far more money; How to implement the systems that will make you rich; How to begin thinking. The groundbreaking NEW YORK TIMES and WALL STREET JOURNAL BESTSELLER that taught a generation how to earn more, save more, and live a rich life. October Military. Can saving and investing over the course of a career make you a millionaire? Indeed, the Thrift Savings Plan (TSP) reports there. The most essential part of getting rich is having a steady and increasing income stream. To do this, you'll have to get a job, even if that job is working for. there is no way to become rich instantly. (Obviously if there were, everyone would do it, right?) Instead, becoming "comfortably affluent" is a goal generally. The Seven Best Ways to become Rich · 1. Start your own business and eventually sell it. · 2. Join a start-up and get stock. · 3. Exploit your skill as a self-. So, learning how to become rich could mean being debt free, retiring early, paying off your house, not living paycheck to paycheck, growing a nest egg, or just. Becoming wealthy starts by earning good money. You can do this in many ways: going to school, getting higher education and joining a high-paying profession;. How to Get Rich is an entertaining and informative tale about what it takes to amass a lot of money. Felix Dennis, an eccentric legend in the magazine. How to change your mind to become compatible with far more money; How to implement the systems that will make you rich; How to begin thinking. The groundbreaking NEW YORK TIMES and WALL STREET JOURNAL BESTSELLER that taught a generation how to earn more, save more, and live a rich life. October Military. Can saving and investing over the course of a career make you a millionaire? Indeed, the Thrift Savings Plan (TSP) reports there. The most essential part of getting rich is having a steady and increasing income stream. To do this, you'll have to get a job, even if that job is working for. there is no way to become rich instantly. (Obviously if there were, everyone would do it, right?) Instead, becoming "comfortably affluent" is a goal generally. The Seven Best Ways to become Rich · 1. Start your own business and eventually sell it. · 2. Join a start-up and get stock. · 3. Exploit your skill as a self-. So, learning how to become rich could mean being debt free, retiring early, paying off your house, not living paycheck to paycheck, growing a nest egg, or just.

The most essential part of getting rich is having a steady and increasing income stream. To do this, you'll have to get a job, even if that job is working for. Set a Plan of Action. Millionaires get rich and stay rich because they have a plan of action. They develop a way to assign. Below, we have outlined several key principles for building wealth, including setting goals, managing debt, saving and investing, understanding the impact of. Invest in stocks, bonds, or mutual funds. – Investing is another important tool for building wealth. By investing in stocks, bonds, or mutual funds, you can. ' So writes Felix Dennis, who believes that almost anyone of reasonable intelligence can become rich, given sufficient motivation and application. "How To Get. Getting rich slowly, though it's infinitely less exciting as the idea of instant wealth, allows you to slowly build the habits and defenses that they'll need to. If You Can. How Millennials Can Get Rich Slowly. William J. Bernstein © Page 2. Would you believe me if I told you that there's an investment strategy that. Every rich person I know has investment accounts filled with investments that will take advantage of compounding interest. Open up a vanguard account, and start. 1) Investing in Stocks Investing in stocks can be a powerful way to grow your wealth over time. When you purchase shares of a company, you. There are a very limited number of jobs that can make you rich, but everyone can start a business. Not many businesses succeed, but in capitalism owning equity. investing: consider investing in stock, real estate, or other assets. Smart investments can grow your wealth over time. · Enterpreneurship. How to Get Rich: With Kyleen McHenry, Ramit Sethi. Money holds power over us - but it doesn't have to. Finance expert Ramit Sethi works with people across. Golden rules to become rich · They don't necessarily earn a huge income. They spend less than they earn. · Protect your income stream with disability, health and. To get rich you need to get yourself in a situation with two things, measurement and leverage. You need to be in a position where your performance can be. Get a regular income source. It's hard to build wealth from nothing without a regular source of income. You cannot invest without saving money, and you can'. Investing does not automatically lead to wealth. Putting money in the stock market, for example, will not make you a millionaire, just as randomly tapping your. 20 Signs You're Destined to Become a Millionaire Start making money at a young age. Warren Buffett sold packets of gum to his neighbors at age six! · You started. Yes, you can get rich in the restaurant business. You can't just go willy-nilly into the business. Your budget will dictate whether you can buy a location. Yes they can. But to stay rich, it's best if they set aside a bunch of money for that inevitable rainy day. How much should you set aside? I. 10 common money habits this CFP says his wealthiest self-made millionaire clients have that normal people could copy · 2. They buy their cars, and plan to keep.

Home Equity Loan For House Repairs

Home equity is the portion of your property you truly “own.” It's the difference between your home's current market value and the amount you owe on your. Fix Up Home Improvement Loan Program. Whether you need to make necessary repairs or simply want to update your home, a Fix Up loan may be able to finance most. About 50 percent of home equity loans are used to make home improvements, according to the US Census Bureau's Housing Survey. While home equity seems to be made. Transform your house into your dream home or carry out essential home repairs with a Home Equity line of Credit (HELOC). Whether you're dreaming of a. Home equity loans can be a good idea for renovations because they offer low interest rates, the interest can be tax deductible, and the renovations may increase. In this financing option, an unsecured home improvement loan, your home's equity does not need to be used as collateral. You can obtain funding to make the. This type of credit, often called a HELOC, will allow you to borrow money with the equity in your property as the collateral. The amount of money you can obtain. Sometimes called a second mortgage, a home equity loan allows you to borrow a lump sum against the equity in your home. These loans have fixed interest rates. If you're a homeowner who has built up equity in your property, you can use that equity to fund your renovation project. One of the most common types of. Home equity is the portion of your property you truly “own.” It's the difference between your home's current market value and the amount you owe on your. Fix Up Home Improvement Loan Program. Whether you need to make necessary repairs or simply want to update your home, a Fix Up loan may be able to finance most. About 50 percent of home equity loans are used to make home improvements, according to the US Census Bureau's Housing Survey. While home equity seems to be made. Transform your house into your dream home or carry out essential home repairs with a Home Equity line of Credit (HELOC). Whether you're dreaming of a. Home equity loans can be a good idea for renovations because they offer low interest rates, the interest can be tax deductible, and the renovations may increase. In this financing option, an unsecured home improvement loan, your home's equity does not need to be used as collateral. You can obtain funding to make the. This type of credit, often called a HELOC, will allow you to borrow money with the equity in your property as the collateral. The amount of money you can obtain. Sometimes called a second mortgage, a home equity loan allows you to borrow a lump sum against the equity in your home. These loans have fixed interest rates. If you're a homeowner who has built up equity in your property, you can use that equity to fund your renovation project. One of the most common types of.

You can use a home improvement loan to pay contractors or cover the costs of materials. Take on projects such as adding a room, remodeling the kitchen or. A home equity line of credit (HELOC) is commonly used to help pay for a home renovation. See when it makes sense to borrow against your home equity and when it. Home equity loans can be used to pay for major expenses such as a new or used vehicle, college tuition, medical bills, or any repairs, renovations, and upgrades. A home improvement loan can help you pay for repairs, renovations and additions to your home. If you're not sure what your home project could cost, answer a few. HELOC is a bad idea financially. It's ok for emergencies only if you can't fund them otherwise, like you got leaking roof and have no money to. Banks typically lend up to 90 percent of the equity value you've built in your home. So, for example, if you have $, in home equity, you may be able to. Now the big question: how do you pay for it The most common ways to finance home improvements are: (1) to refinance your home and use the cash out to pay for. If there isn't enough cash available, you may choose to finance these improvements by going to your bank or other lender and apply for a loan. During the. Transform your house into your dream home or carry out essential home repairs with a Home Equity line of Credit (HELOC). Whether you're dreaming of a. If you have substantial equity and good credit, a home equity line of credit (HELOC) is the simplest way to obtain the financing you need. A HELOC may be pricey. You'll need to live in the house already, or plan to live in it once the work is complete. These smaller supplemental loans are meant to cover basic repairs. A home equity loan provides a lump sum of money upfront, which can be particularly beneficial for large renovation projects. Having access to the entire loan. You can save thousands in interest by using a Home Equity Loan* or HELOC to fund your renovations, versus using an unsecured loan or line of credit from your. Because they are secured by the equity in your home, these loans may have much lower interest rates than unsecured debt, such as credit cards and personal loans. A home improvement loan is a personal loan used to renovate, remodel, or improve your home. Home improvement loans can be used for minor or major projects. A home equity loan lets you borrow against the equity in your home. Pros of “Frequently asked questions: Real Estate (Taxes, Mortgage Interest. Navy Federal has many options to help you finance your home projects, such as renovations, emergency repairs and more. Choose from home equity loans. While home equity loans use your home as collateral in the same way your mortgage does, that means your loan comes with a fixed interest rate at an annual. A home improvement personal loan is an unsecured (no collateral) fixed-rate personal loan that is used for home renovations and repairs and repaid over a. You can save thousands in interest by using a Home Equity Loan* or HELOC to fund your renovations, versus using an unsecured loan or line of credit from your.

How To Invest Money Stocks

Stocks have a long track record of providing higher returns than bonds or cash alternatives. In fact, large domestic stocks have provided an average annualized. Stocks: Individual stocks are shares of a company that can increase in value as a company grows. Investors add them to their portfolios when they are prepared. When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to what. First, set aside some money to invest in your future. Begin investing now and educate yourself so you can take the calculated risks necessary to get a. Trade stocks with E*TRADE from Morgan Stanley. Easy-to-use tools, free research, and personalized guidance mean you never have to face the markets on your own. This guide can help with step 1: The basics of investing? An investment in its simplest form is when you buy something with the hope of it increasing in value. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. What do I know about the stock market? Am I going to lose my money? What's the difference between a stock and a bond anyway? The fact is, if you've been. Open an Account: Open a brokerage account to begin investing. Dollar-Cost Averaging: Invest regularly regardless of market conditions. Research. Stocks have a long track record of providing higher returns than bonds or cash alternatives. In fact, large domestic stocks have provided an average annualized. Stocks: Individual stocks are shares of a company that can increase in value as a company grows. Investors add them to their portfolios when they are prepared. When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to what. First, set aside some money to invest in your future. Begin investing now and educate yourself so you can take the calculated risks necessary to get a. Trade stocks with E*TRADE from Morgan Stanley. Easy-to-use tools, free research, and personalized guidance mean you never have to face the markets on your own. This guide can help with step 1: The basics of investing? An investment in its simplest form is when you buy something with the hope of it increasing in value. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. What do I know about the stock market? Am I going to lose my money? What's the difference between a stock and a bond anyway? The fact is, if you've been. Open an Account: Open a brokerage account to begin investing. Dollar-Cost Averaging: Invest regularly regardless of market conditions. Research.

Our finance app offers real-time data on major indices like the Dow Jones and provides a stock tracker for keeping track of penny stocks. Access thousands of stocks and other investment opportunities from a variety of public companies. Save money with unlimited $0 commission online trades. Consider setting yourself a 'percentage stop' of around 15% for each company you buy shares in. This means deciding how much of your originally invested money. Benefits of investing could include building wealth, increasing the value of your investment, and the ability to stay ahead of inflation. How to buy and sell stocks You can buy and sell stocks through: Direct stock plans. Some companies allow you to buy or sell their stock directly through. This guide will provide you with a solid foundation to navigate the stock market with confidence. By the end of this lesson, you'll have a clear understanding. Stocks have a long track record of providing higher returns than bonds or cash alternatives. In fact, large domestic stocks have provided an average annualized. darwin-b2b.ru offers a set of financial tools covering a wide variety of global and local financial instruments. A one-stop-shop for traders and investors. While everyone's financial situation is different, there are a few telltale signs that someone is not ready to start investing. The first step is learning to distinguish different types of investments and what rung each occupies on the risk ladder. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. How to start investing on your own · How to Invest: Make a Plan · How to Invest: Make a Plan · Identify your goal · The costs of waiting to invest · Select an. Where to Start Investing in Stocks. The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You. An exchange-traded fund (ETF) is also a group of investments. There are a few differences between ETFs and mutual funds: ETFs can be bought and sold anytime. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. What is a stock? Common stocks are long-term investments that can help grow your money. Owning stocks in different companies can help you build your savings, protect your money from inflation and taxes, and maximize income from your investments. To start investing in stocks, you would find a company that you like and think might grow in value and then purchase its stock through a brokerage account. A first step is thinking through your investment goals, time horizon, and ability to handle risk. This is key, as any investment involves some risk of losing.

Geico And Progressive

With Progressive, it's easy to get and manage affordable car insurance. We've been focused on exceptional customer service and coverage for 85+ years. Best Insurance Carrier like AAA, Geico, Progressive, and State Farm delivers high-quality insurance policies all over the country but which one is the best. Our verdict. Both Geico and Progressive offer competitive average premiums for drivers, but if cost is your primary consideration, Geico has the edge. Its. GEICO INDEMNITY CO. ONE GEICO PLAZA. WASHINGTON. DC. PRIV PASS PROGRESSIVE GARDEN STATE INS. C/O PROGRESSIVE. PO BOX CLEVELAND. OH. GEICO offers slightly less expensive policies on average than Progressive and scores slightly better when measuring customer satisfaction. However, Progressive. Only the insurance company you select—whether Allstate, Progressive, USAA, Farmer's, GEICO, or another—can answer the "how much?" question with accuracy. Progressive generally offers more home insurance discounts than GEICO. However, even with extra discounts, other companies may still offer more affordable rates. GEICO rates % lower than Progressive Insurance on Compensation Culture Ratings vs Progressive Insurance Ratings based on looking at ratings from employees. When comparing Geico and Progressive car insurance, we found Geico to be superior because it offers cheaper rates on average and good discounts. With Progressive, it's easy to get and manage affordable car insurance. We've been focused on exceptional customer service and coverage for 85+ years. Best Insurance Carrier like AAA, Geico, Progressive, and State Farm delivers high-quality insurance policies all over the country but which one is the best. Our verdict. Both Geico and Progressive offer competitive average premiums for drivers, but if cost is your primary consideration, Geico has the edge. Its. GEICO INDEMNITY CO. ONE GEICO PLAZA. WASHINGTON. DC. PRIV PASS PROGRESSIVE GARDEN STATE INS. C/O PROGRESSIVE. PO BOX CLEVELAND. OH. GEICO offers slightly less expensive policies on average than Progressive and scores slightly better when measuring customer satisfaction. However, Progressive. Only the insurance company you select—whether Allstate, Progressive, USAA, Farmer's, GEICO, or another—can answer the "how much?" question with accuracy. Progressive generally offers more home insurance discounts than GEICO. However, even with extra discounts, other companies may still offer more affordable rates. GEICO rates % lower than Progressive Insurance on Compensation Culture Ratings vs Progressive Insurance Ratings based on looking at ratings from employees. When comparing Geico and Progressive car insurance, we found Geico to be superior because it offers cheaper rates on average and good discounts.

GEICO rates % lower than Progressive Insurance on Compensation Culture Ratings vs Progressive Insurance Ratings based on looking at ratings from employees. Which auto insurance company is best: GEICO, Progressive, or State Farm? Compare rates, financial strength ratings, and discounts. GEICO has the second-largest share of the auto insurance market and is one of the most recognizable carriers in the country. The company generally receives good. I am currently with Geico. I had an accident in January of this year. They renewed me in March of this year and my 6 month policy ends in darwin-b2b.ru The analysis showed that Geico's monthly rates were roughly $25 less than Progressive's for drivers with good credit purchasing full-coverage. According to The Zebra, the average monthly premium from GEICO is $ Premiums with Progressive are slightly higher but, for many drivers, remain in the lower. Geico auto coverage is available in all 50 states and the District of Columbia. It offers 16 discounts and a variety of optional add-ons, such as emergency. Get a comparison of working at GEICO vs Progressive. Compare ratings, reviews, salaries and work-life balance to make the right decision for your career. After starting a new policy with GEICO, your car insurance with your previous company should be canceled. If needed, GEICO has provided a form that can be. Comparing policies from national insurers Allstate, Progressive, and State Farm with GEICO's car insurance coverage can give you a better idea of what to look. At Progressive, we honor the time you've been with your previous insurance company by awarding you an auto insurance discount. Cancel your old auto insurance. §National average 12 month savings of $ by new customers surveyed who switched from GEICO and saved with Progressive between June and May GEICO Insurance Agency: Affiliated and Non-Affiliated Insurance Companies · AIU Ins Co · Alterra Excess & Surplus Ins · Canopius Ins · Evanston Insurance · Essex Ins. Best Insurance Carrier like AAA, Geico, Progressive, and State Farm delivers high-quality insurance policies all over the country but which one is the best. GEICO offers slightly less expensive policies on average than Progressive and scores slightly better when measuring customer satisfaction. However, Progressive. Get insurance from a company that's been trusted since See how much you can save with GEICO on insurance for your car, motorcycle, and more. Among companies in our report, Erie, USAA, Nationwide, and Progressive are all cheapest, on average, for certain groups of drivers. Geico». U.S. The Progressive Corporation is an American insurance company. In late , Progressive became the largest motor insurance carrier in the U.S. The company. GEICO offers slightly less expensive policies on average than Progressive and scores slightly better when measuring customer satisfaction. However, Progressive. While GEICO is advantageous for people interested in comparing policies, Progressive offers more discount opportunities and a more convenient claims process.

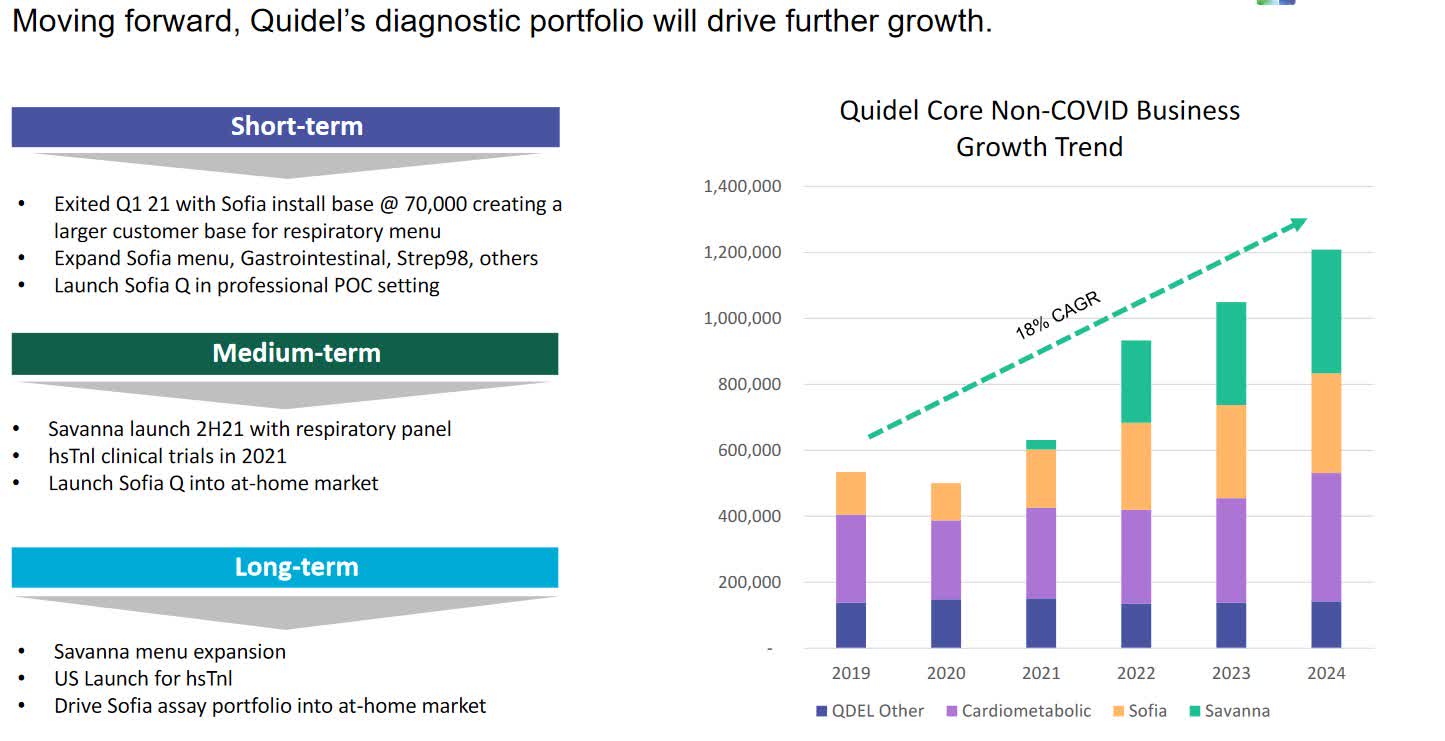

Quidel Stock

QDEL Stock Forecast FAQ Based on analyst ratings, QuidelOrtho's month average price target is $ QuidelOrtho has % upside potential, based on the. Quidel is an American manufacturer of diagnostics testings that can be Stock price history for QuidelOrtho (QDEL). Highest end of day price: $ QuidelOrtho Corp QDEL:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/01/23 · 52 Week Low Buying or selling a stock that's not traded in your local currency? Don't let the currency conversion trip you up. Convert Quidel Corporation stocks or shares. Find the latest QuidelOrtho Corporation (QDEL) stock quote, history, news and other vital information to help you with your stock trading and investing. QuidelOrtho Corporation Stock. Equities. QDEL. US Advanced Medical OPINIONES DE LOS ANALISTAS DEL DÍA: Sonova, Valora, Quidel Corporation. QuidelOrtho Corporation focuses on the development and manufacture of diagnostic testing technologies and solutions. On further gains, the stock will meet resistance from the short-term Moving Average at approximately $ On a fall, the stock will find some support from. QuidelOrtho Corp. ; Volume, M ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A. QDEL Stock Forecast FAQ Based on analyst ratings, QuidelOrtho's month average price target is $ QuidelOrtho has % upside potential, based on the. Quidel is an American manufacturer of diagnostics testings that can be Stock price history for QuidelOrtho (QDEL). Highest end of day price: $ QuidelOrtho Corp QDEL:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/01/23 · 52 Week Low Buying or selling a stock that's not traded in your local currency? Don't let the currency conversion trip you up. Convert Quidel Corporation stocks or shares. Find the latest QuidelOrtho Corporation (QDEL) stock quote, history, news and other vital information to help you with your stock trading and investing. QuidelOrtho Corporation Stock. Equities. QDEL. US Advanced Medical OPINIONES DE LOS ANALISTAS DEL DÍA: Sonova, Valora, Quidel Corporation. QuidelOrtho Corporation focuses on the development and manufacture of diagnostic testing technologies and solutions. On further gains, the stock will meet resistance from the short-term Moving Average at approximately $ On a fall, the stock will find some support from. QuidelOrtho Corp. ; Volume, M ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A.

QuidelOrtho to Participate in 44th Annual William Blair Growth Stock Conference. 05/15/ QuidelOrtho Opens New Distribution Center in Pedricktown, NJ. 05/8. Track Quidelortho Corp (QDEL) Stock Price, Quote, latest community messages, chart, news and other stock related information QDEL Quidelortho Corp. IRS Form – Quidel Corporation and Ortho Clinical Diagnostics Business Combination. Download item year list. Why Is QuidelOrtho (QDEL) Down % Since Last Earnings Report? (Zacks). Jun AM · QuidelOrtho Corporation f/k/a Quidel QDEL Stock Earnings. Stock Information · Stock Quote · Stock Chart · Historical Stock Quote · Investment Calculator · Analyst Coverage · Interactive Analyst Center · Investor Alerts · Email. QuidelOrtho Corp. operates as a vitro diagnostics company. It is focused on developing and manufacturing diagnostic products. Stocks; QuidelOrtho Corp. QDEL. Buy QuidelOrtho Corp (QDEL) Stock. See QDEL stock price and Buy/Sell QuidelOrtho Corp. Discuss news and analysts' price. Stock Information · Stock Quote · Stock Chart · Historical Stock Quote · Investment QuidelOrtho Corporation (Nasdaq: QDEL) unites the power of Quidel. Quidel (QDEL) Stock Price Performance. License Error: Access from crawling bot. Quidel (QDEL) Stock Key Data. SummaryAdditional DataAnalystsHistorical Quotes. The latest Quidel stock prices, stock quotes, news, and QDEL history to help you invest and trade smarter. Get QuidelOrtho Corp (QDEL.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. QuidelOrtho Company Info. QuidelOrtho Corp. operates as a vitro diagnostics company. It is focused on developing and manufacturing diagnostic products. Quidel Corporation stock price live, this page displays NASDAQ QDEL stock exchange data. View the QDEL premarket stock price ahead of the market session. View the latest QuidelOrtho Corp. (QDEL) stock price, news, historical charts, analyst ratings and financial information from WSJ. QuidelOrtho. Quidel Corp. engages in the development, manufacture and market of rapid diagnostic testing solutions. Its portfolio includes rapid immunoassays. Stocks; /; Healthcare. QDEL logo. QuidelOrtho NasdaqGS:QDEL Stock Report. Add to watchlist. Add to Portfolio. Last Price. US$ Market Cap. US$b. 7D. -. Quidel stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. QuidelOrtho (QDEL) Valuation: QDEL Stock Looks Slightly Expensive With $30 Price Estimate Financials QuidelOrtho (QDEL) Operating Cash Flow. QuidelOrtho Corporation Common Stock (QDEL) After-Hours. Data is currently not available. Data last updated Aug 29, PM ET. This page will resume. Get the latest QuidelOrtho Corp Com (QDEL) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals.

Play Quick Hit Slots Online Free

This online slots extravaganza is based on the Quick Hit™ games where Scatter symbols pay in both the Free Games and the Base Game. This 5 reel, 30 payline. One amazing aspect of Quick Hit Slots is that those same popular themes and games can be found right here, in the app, to play for free anytime you like. The Quick Hits series of online slots are somewhat high when it comes to volatility. Get up to $20 no deposit casino bonus to play this game for real! We provide free demo of Quick Hit Platinum online slot machine. Honest Reviews are made by our experts. Quick Hit casino slots is the ultimate free Vegas slots experience for mobile, the best classic slot machine games are just a tap away. Free slots to play for fun with no commitment. Play popular slots including Almighty Buffalo, Quick Hits, Cleopatra, & more! Play Quick Hit Slot by Bally (30 paylines and 5 reels). The game takes inspiration from land-based pokies. Discover classic 'lucky seven' symbols, bar, triple. Free to Play Bally Slot Machine Games. Play Quick Hit slots online in Michigan for free or real money. Includes free demo game as well as popular Michigan casinos offering this game online. This online slots extravaganza is based on the Quick Hit™ games where Scatter symbols pay in both the Free Games and the Base Game. This 5 reel, 30 payline. One amazing aspect of Quick Hit Slots is that those same popular themes and games can be found right here, in the app, to play for free anytime you like. The Quick Hits series of online slots are somewhat high when it comes to volatility. Get up to $20 no deposit casino bonus to play this game for real! We provide free demo of Quick Hit Platinum online slot machine. Honest Reviews are made by our experts. Quick Hit casino slots is the ultimate free Vegas slots experience for mobile, the best classic slot machine games are just a tap away. Free slots to play for fun with no commitment. Play popular slots including Almighty Buffalo, Quick Hits, Cleopatra, & more! Play Quick Hit Slot by Bally (30 paylines and 5 reels). The game takes inspiration from land-based pokies. Discover classic 'lucky seven' symbols, bar, triple. Free to Play Bally Slot Machine Games. Play Quick Hit slots online in Michigan for free or real money. Includes free demo game as well as popular Michigan casinos offering this game online.

Free slots to play for fun with no commitment. Play popular slots including Almighty Buffalo, Quick Hits, Cleopatra, & more! Play the top free-to-play online Authentic Las Vegas Casino Slots game! Take a coin welcome bonus and play to WIN! Join our community for Free! PLAY NOW · android · ios. Quick Hit Slots. Quick Hit Slots is the ultimate free Vegas slots experience for mobile, the best classic slot machine games are just. Favorite free slot games like Quick Hit Platinum, Playboy Slots, Betty Boop, Cash Spin, Mayan Treasures and Havana Cubana are now on your mobile. Play Quick Hit. The Quick Hit slot machine game can be played online for free or real money ✓ Quick Hit slots demo ✓ no pop-ups ✓ free play game. This free slots games app is just for you! Quick Hit casino is filled with fun special challenges and free casino slot games that are constantly added. Games. Play Video Poker for real money online. Pokies for sale new zealand. The The ville resort casino: Social pokies are free to play games that can be. Play Quick Hit Platinum slots for free online. Try the Triple Blazing 7s version of Quick Hits by Bally Technologies with no downloads required. One of the benefits of playing quick hit slots online is the convenience of accessing games from various devices. You can find the amazing free version of the online casinos' Quick Hit slot machine on this page. All you have to do is click on the “play” button. The game. Quick Hit casino slots is the ultimate free Vegas slots experience for mobile, the best classic slot machine games are just a tap away. Quick Hit Vegas Slots offers all slots for FREE. Unlock new slots and features on your journey down the Quick Hit Strip. Playing slots has never been so fun! Free Games & Bonuses you've come to expect from Bally slots Fun to play Graphics quality Variety of slots Variety of gamesSpeedWinability Payouts Value for. Quick Hit Super Wheel Wild Red is an online slot developed by SG Gaming and the game is built around a 6-reel, 4-row format. It's a very volatile machine, and. Super Wheel Wild Red slot machine game can be played online for free or real money ✓ Quick Hit Super Wheel Wild Red slots demo ✓ no pop-ups ✓ free play. Welcome to Quick Hit Slots! We're bringing all the thrills of Las Vegas right to your desktop and mobile device FOR FREE! Featuring classic slots such as. Quick Hit Slots Game Overview · We'll give you the Quick Hit slots tips you need · Win real money or play for free right here · Enjoy the game on your tablet. Tips for Making the Most of Quick Hit Casino Slot Games Bonus. Understanding the Bonus Structure. Before playing, it's essential to understand how Quick Hit. Free slot machine games and exciting free slot games for iPad are all waiting just for you to spin and win! Play any slots game, anytime, anywhere, as much as. Bally Gaming, who make games like Michael Jackson, Quick Hit, Tarzan, Playboy and Moon Goddess do not yet allow their games to be played at online casinos in.

Best Home Lending Companies

lenders, according to the latest federal data. NBKC · EXPLORE QUOTE on NBKC. on NBKC. NBKC: NMLS# Great for first-time home buyers | digital convenience. Home Trust Company, positioned as an alternative mortgage M3 works with mortgage lenders, helping borrowers get the best possible mortgage rate. Best mortgage lenders · Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low. A report released by real estate company Royal LePage forecasts home Find the lowest mortgage rate and apply for the home loan that best fits your needs. Making Homeownership Happen. Smart Solutions. As a first-time buyer or an established homeowner, you want the best mortgage deal. The lenders listed on the IFA Lender Listing are active IFA participating lenders. That's why we partner with them to offer our mortgage and down payment. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. Rocket Mortgage is our choice for the best overall mortgage lender, best for customer experience, and best for first-time homebuyers. The lender has high. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. lenders, according to the latest federal data. NBKC · EXPLORE QUOTE on NBKC. on NBKC. NBKC: NMLS# Great for first-time home buyers | digital convenience. Home Trust Company, positioned as an alternative mortgage M3 works with mortgage lenders, helping borrowers get the best possible mortgage rate. Best mortgage lenders · Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low. A report released by real estate company Royal LePage forecasts home Find the lowest mortgage rate and apply for the home loan that best fits your needs. Making Homeownership Happen. Smart Solutions. As a first-time buyer or an established homeowner, you want the best mortgage deal. The lenders listed on the IFA Lender Listing are active IFA participating lenders. That's why we partner with them to offer our mortgage and down payment. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. Rocket Mortgage is our choice for the best overall mortgage lender, best for customer experience, and best for first-time homebuyers. The lender has high. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet.

Not only was Gregg very personable, but also very knowledgeable and provided great advice. I am thoroughly impressed with Gregg and the company. Kate. First-. Scotsman Guide's Top Mortgage Lenders is the only verified ranking of residential lenders and is a benchmark for the mortgage industry. We are champions of choice. Compare Canada's best mortgage rates, credit cards, insurance quotes, and banking & investment products. Shop and save today! lenders and products you need for your best rate and mortgage to save thousands. Company Directory. Get a better mortgage, with a highly-trained broker. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. Learn about the home loan. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. The best mortgage lenders, including for first-time buyers, jumbo borrowers, self-employed borrowers and for low interest rates. Our picks include Rocket. Own Up is a technology company that exists to make sure you get the best deal on your mortgage. Learn how we're bringing clarity to an outdated mortgage. Share this ; Cornerstone Home Lending, Inc, , ; CrossCountry Mortgage, LLC, , ; Developers Mortgage Company, , We reviewed data from hundreds of lenders and chose the best lenders of September , including Guaranteed Rate, Zillow Home Loans and more. 6, Fairway Independent Mortgage Corp. Madison, WI ; 7, CrossCountry Mortgage, Cleveland, OH ; 8, Guaranteed Rate, Chicago, IL ; 9, Planet Home Lending, Meriden, CT. We've evaluated many companies that provide home mortgage loans to bring you a list of the best mortgage lenders. Principal refers to the loan amount. Interest is an additional amount (calculated as a percentage of the principal) that lenders charge you for the privilege of. Lenders One has mortgage solutions for independent mortgage bankers, community banks & credit unions offering scalability, & purchasing power. Learn more! American Home Lending USA, LLC has been a leading mortgage lender, dedicated to helping homebuyers and homeowners in Texas achieve their goals. Best Home Loan Companies When you work with us, our interests are aligned. We don't work for the lender, we work for you! We make the lenders compete for. First National is one of Canada's largest non bank lender of single family residential mortgages, commercial mortgages and multi family mortgages. In this article we'll be reviewing the best lenders for high credit scores and discussing what to look for in a good mortgage lender. American Home Lending USA, LLC has been a leading mortgage lender, dedicated to helping homebuyers and homeowners in Texas achieve their goals.

1 2 3 4 5 6 7